south dakota sales tax rate changes 2021

Municipalities may impose a general municipal sales tax rate of up to 2. Change Date Tax Jurisdiction Sales Tax Change Cities Affected.

Minnesota Tax Rates Rankings Minnesota State Taxes Tax Foundation

South Dakota has a statewide sales tax rate of 45 which has been in place since 1933.

. Municipal governments in South Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 65 across the state with an average local tax of 1817 for a total of 6317 when combined with the state sales tax. In addition the town of Henry is amending their municipal tax rate from 1 to 2. Reduce audit risk as your business gets more complex.

The state sales tax rate in South Dakota is 45 but you can customize this table as needed to reflect your applicable local sales tax rate. The South Dakota. The following are recent sales tax rate.

South Dakota municipalities are able to implement new tax rates or change existing tax rates on January 1 or July 1 each year. September 2021 Sales Tax Changes - 147 changes in 20 states. Raised from 55 to 65 Gary.

South Dakota has state sales tax of 45 and allows local governments to collect a. For additional information on sales tax please refer to our Sales Tax Guide PDF. Simplify South Dakota sales tax compliance.

10 rows Raised from 45 to 65. Ad Find Out Sales Tax Rates For Free. South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax.

The South Dakota state sales tax rate is currently. Find your South Dakota combined state and local tax rate. South Dakota sales tax rates vary depending on which county and city youre in which can make finding the right sales.

Raised from 625 to 9875. Fast Easy Tax Solutions. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

The Turner County sales tax rate is. The 2018 United States Supreme Court. We provide sales.

Tax rates are provided by Avalara and updated monthly. What is South Dakotas Sales Tax Rate. Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax.

The state sales and use tax rate is 45. Get Your First Month Free. The minimum combined 2021 sales tax rate for Turner County South Dakota is.

Ad DAVO Sets Aside Files Pays Your Sales Tax On Time So You Can Focus On Your Business. 2 rows South Dakota SD Sales Tax Rate Changes. The maximum local tax rate allowed by.

The base state sales tax rate in South Dakota is 45. Look up 2022 sales tax rates for Chance South Dakota and surrounding areas. This is the total of state and county sales tax rates.

Tax rates provided by Avalara are updated monthly. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. Average Sales Tax With Local.

The maximum local tax rate allowed by. This is the total of state county and city sales tax rates. Municipal governments in South Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 65 across the state with an average local tax of 1814 for a total of 6314 when combined with the state sales tax.

Beginning January 1 2022 the town of Lane is implementing a new municipal tax rate from 0 percent general sales and use tax rate to 2 percent. As of January 1 2021. Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65.

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. The South Dakota Department of Revenue administers these taxes. If you need access to a regularly-updated database.

Exemptions to the South Dakota sales tax will vary by state. The city of Buffalo Chip is removing its 200 general sales and use tax. Look up 2021 sales tax rates for Day County South Dakota.

You may want to change the basemap. The Richland sales tax rate is. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services.

The city of Faulkton is imposing a 100 municipal gross receipts tax rate on lodging eating establishments and alcoholic beverages. 31 rows South Dakota SD Sales Tax Rates by City. Ad Integrates Directly w Industry-Leading ERPs.

This tax is in addition to its 200 general sales and use tax rate. If you need access to a regularly-updated database of sales tax rates take a look at our sales tax data page. 366 rows 2022 List of South Dakota Local Sales Tax Rates.

The South Dakota sales tax rate is 4 as of 2022 with some cities and counties adding a local sales tax on top of the SD state sales tax. What is South Dakotas Sales Tax Rate. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000.

See the South Dakota Department of Revenue for additional details. Tax Rate Starting Price. What Rates may Municipalities Impose.

The South Dakota sales tax and use tax rates are 45.

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only State To Inheritance Tax Estate Tax States

Hawaii Tax Rates Rankings Hawaii State Taxes Tax Foundation

Ebay Sales Tax Everything You Need To Know Guide A2x For Amazon And Shopify Accounting Automated And Reconciled

Hawaii Tax Rates Rankings Hawaii State Taxes Tax Foundation

Hawaii Tax Rates Rankings Hawaii State Taxes Tax Foundation

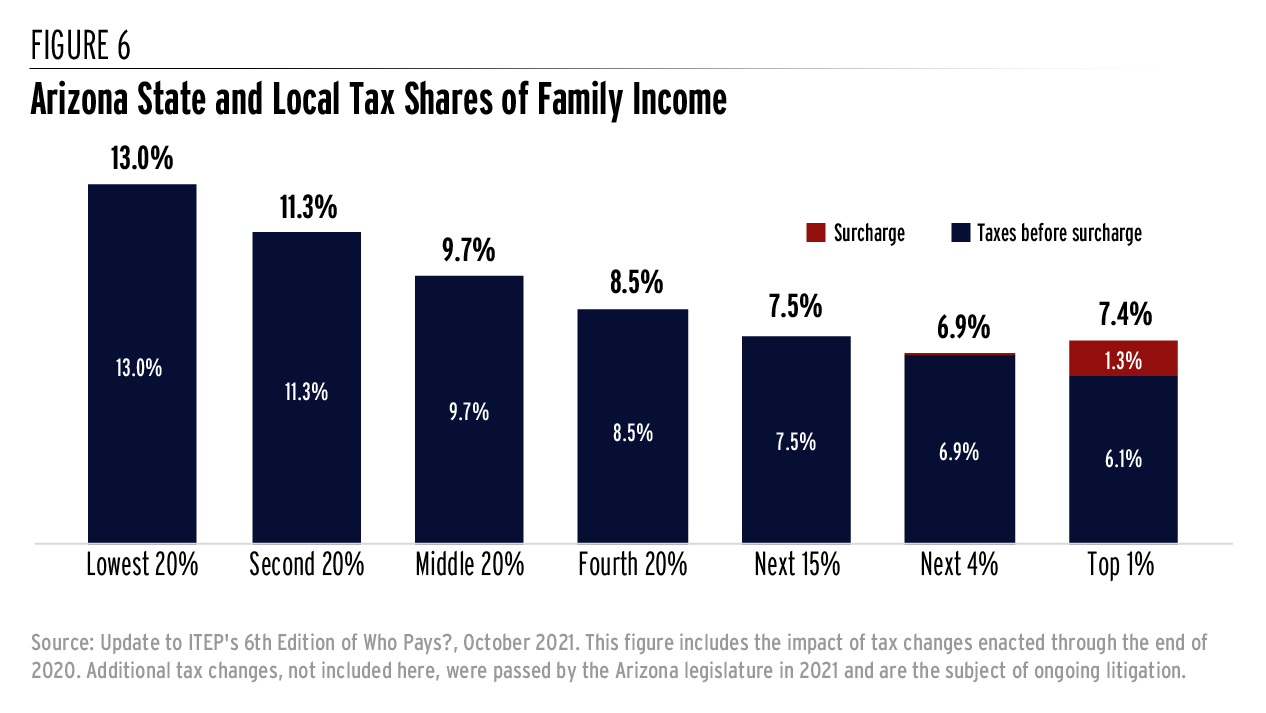

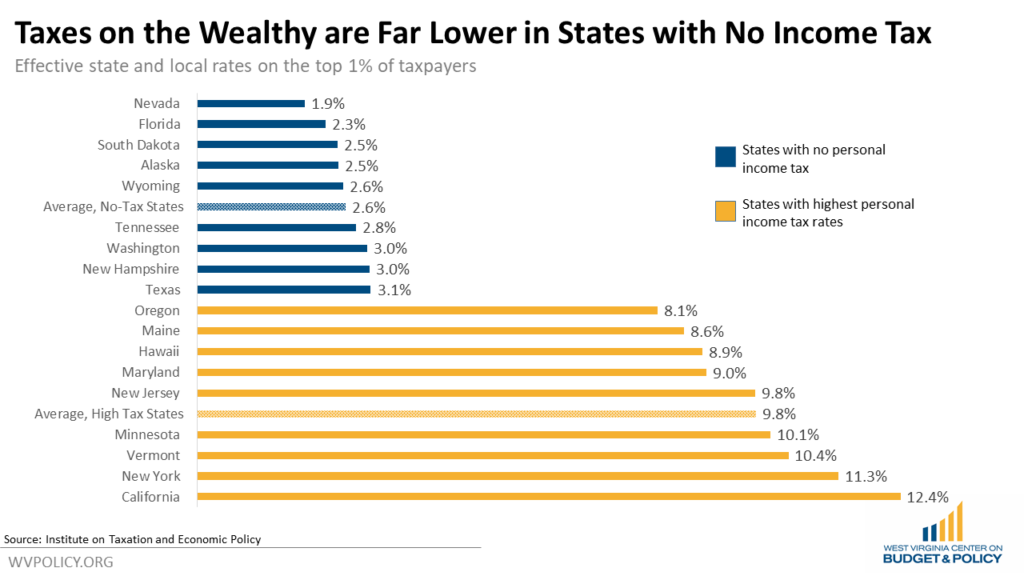

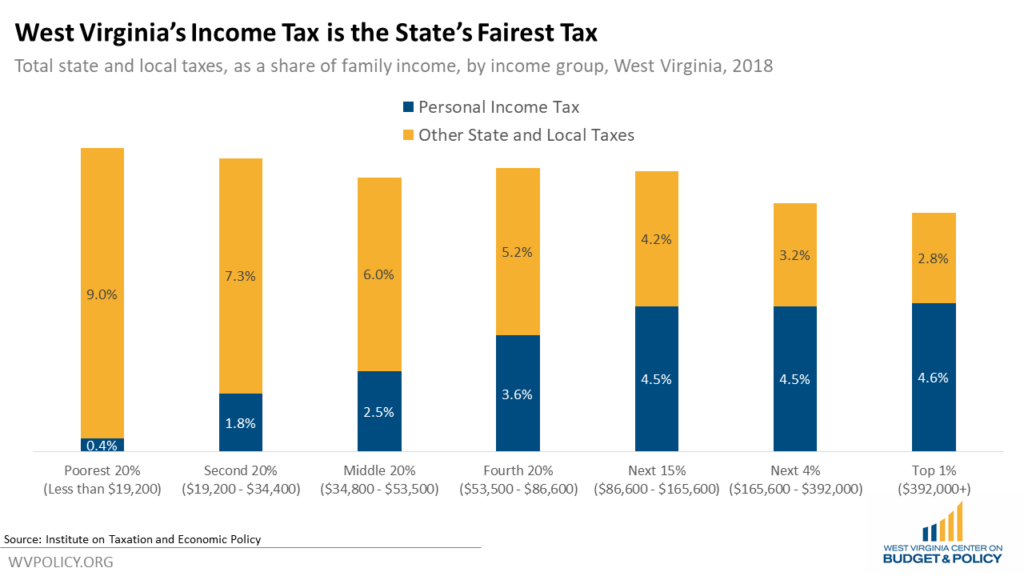

Eliminating The Income Tax Benefits The Wealthy While Undermining Important Public Investments West Virginia Center On Budget Policy

How High Are Capital Gains Taxes In Your State Tax Foundation

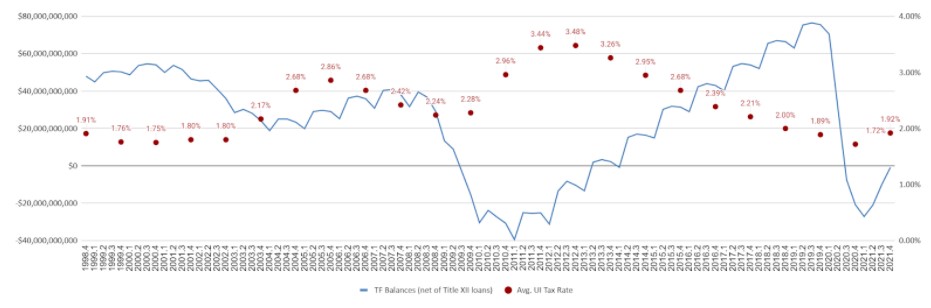

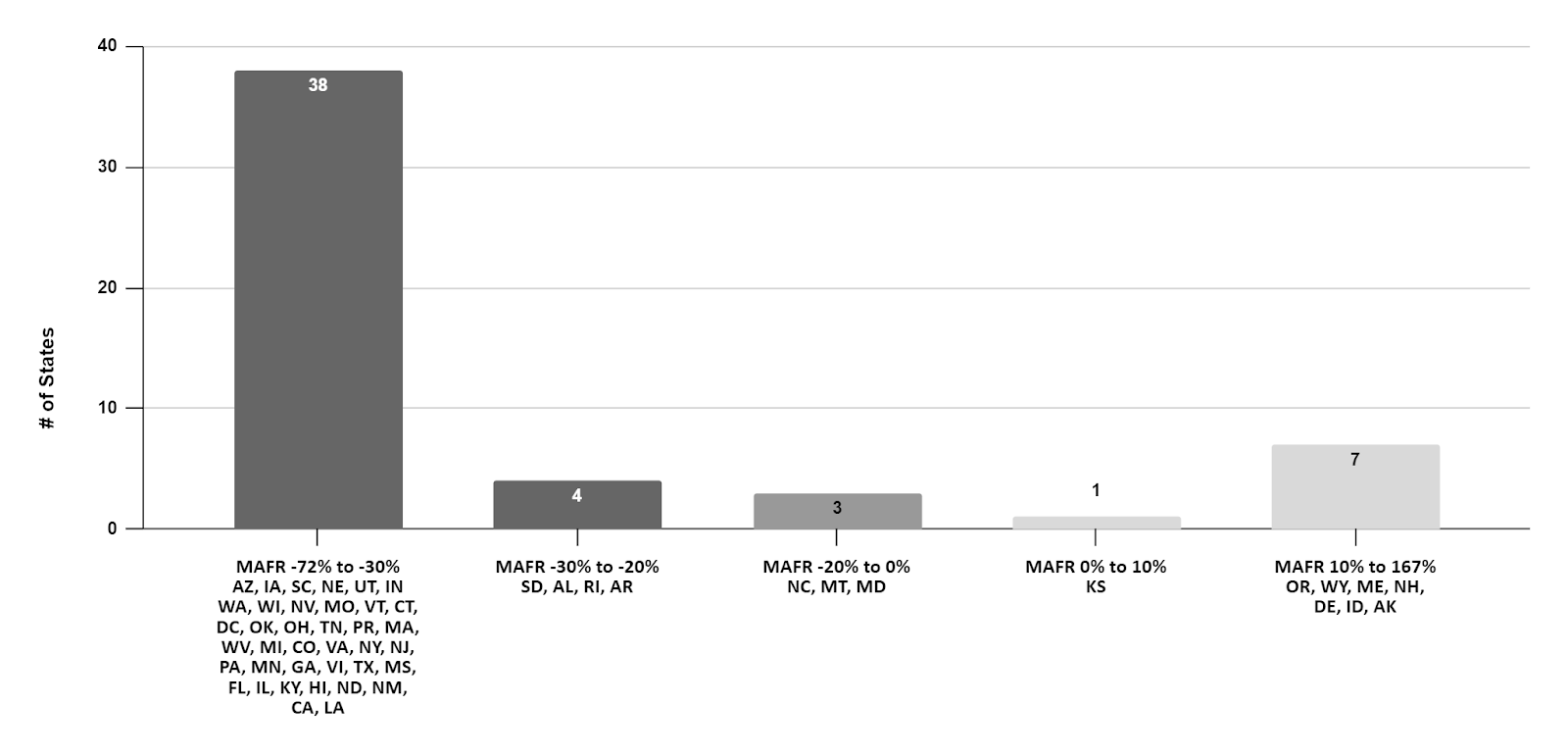

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Hawaii Tax Rates Rankings Hawaii State Taxes Tax Foundation

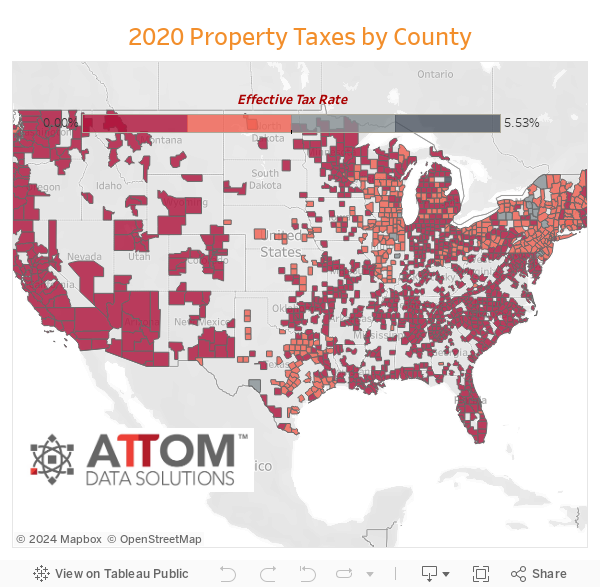

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

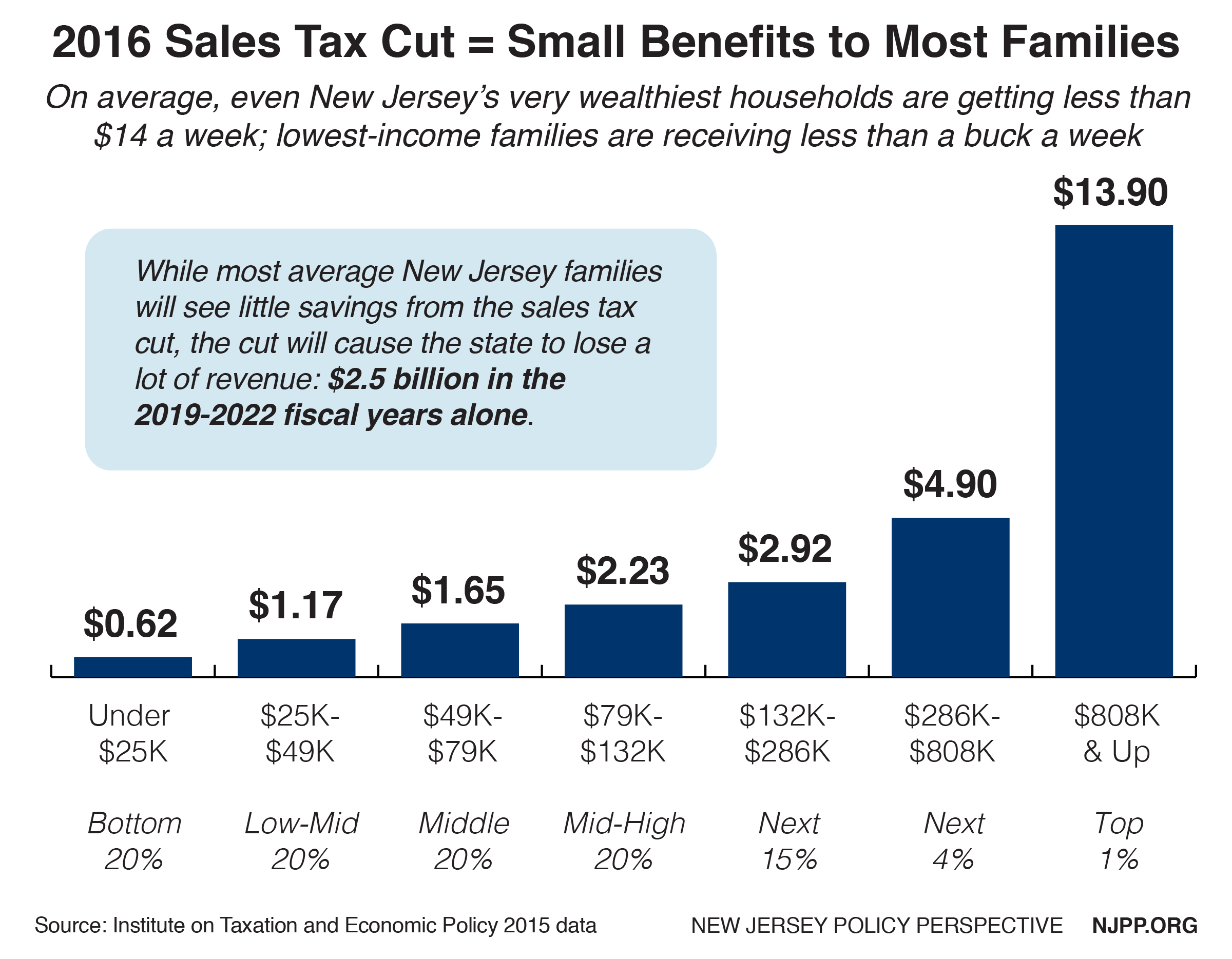

Modernizing New Jersey S Sales Tax Will Level The Playing Field And Help The Economy Thrive New Jersey Policy Perspective

Hawaii Tax Rates Rankings Hawaii State Taxes Tax Foundation

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Eliminating The Income Tax Benefits The Wealthy While Undermining Important Public Investments West Virginia Center On Budget Policy