carried interest tax rate 2021

Code Section 1061 was enacted in 2017 to place limits on the ability of carried interest arrangements to be eligible for preferential long-term capital gain LTCG rates instead of higher ordinary. Even within this exemption amounts can still be brought back within the DIMF rules if.

Asset Management Tax Update of 29 January 2021 provided an overview of the Carried Interest Tax Concession Bill.

. The law known as the Tax Cuts and Jobs Act PL. The Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 passed its third reading in the Legislative Council unamended and once published in the official gazette will become law. Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains tax.

The managers pay a federal personal income tax on these gains at a rate of 238 percent 20. Dubbed the Carried Interest Fairness Act of 2021 or HR 1068 the bill would allow fund managers who put their own money in a funda common practice in private equityto still treat those profits as capital gains. Carried Interest Fairness Act of 2021.

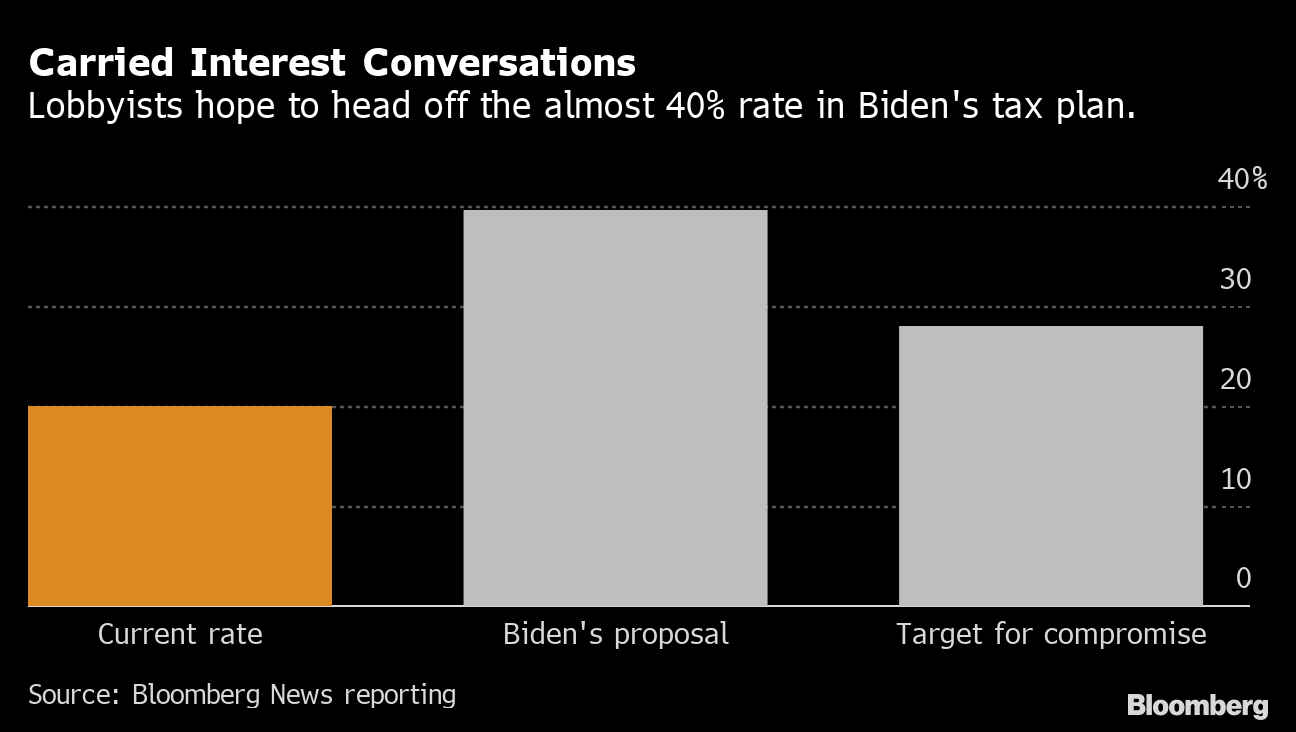

Lobbyists shielded carried interest from Bidens tax hikes top White House economist says Published Thu Sep 30 2021 1243 PM EDT Updated Thu Sep 30 2021 202 PM EDT Christina Wilkie. Senators Tammy Baldwin D-WI Joe Manchin D-WV and Sherrod Brown D-OH today introduced tax reform legislation to close the carried interest tax loophole that benefits wealthy money managers on Wall Street. These rules make some notable and mostly taxpayer-friendly changes to regulations proposed in July 2020.

The preferential tax rate is especially important for a private equity fund and its managers. This bill modifies the tax treatment of carried interest which is compensation that is typically received by a partner of a private equity or hedge fund and is based on a share of the funds profits. Proceeds from that individuals partnership interest are often taxed as capital gain rather than ordinary income.

7 2021 providing guidance on the carried interest rules under Section 1061. September 13 2021 321 PM UTC. The Biden administrations proposal to tax carried interest at a higher rate.

Code Section 1061 was enacted in 2017 to place limits on the ability of carried interest arrangements to be eligible for preferential long-term capital gain LTCG rates instead of higher ordinary income tax rates. Carried interest offers lower tax rate than for income. News June 30 2021 at 0208 PM Share Print.

A key exemption from these rules is the carried interest exemption which if met means that amounts should be subject to capital gains tax at a lower rate of 28. This 20 percent long-term capital gain rate is lower than the marginal tax rate applied to most families in 2021 single filers would pay a marginal tax rate of 22 percent of their taxable income if they earn over 40525 81051 for married couples filing jointly. Section 1061 was enacted as part of the Tax Cuts and Jobs Act TCJA and requires a three.

President Joe Bidens plans would tax carried interest which private equity managers earn from the investments they make at rates as high as 396 against 20 today. Under current law carried interest is taxed as investment income rather than at ordinary income tax rates. 115-97 extended the holding period for certain carried interests applicable partnership interests APIs to three years to be eligible for capital gain treatment.

A private equity fund typically uses carried interest to pass through a share of its net capital gains to its general partner which in turn passes the gains on to the investment managers figure 1. Raising the capital gains rate for households making over 1 million. The American Families Plan also includes these proposals.

The final regulations generally retain the structure of proposed regulations issued last July but also make several important changes. January 7 2021. The legislation is the culmination of an extensive consultation process.

This means that private equity managers pay a lower marginal tax rate on the carried interest. Senators Baldwin Manchin and Brown. This plan is financed by new tax increases including increasing the personal rate for top earners from 37 to 396.

The concessional tax treatment for carried interest is now effective from 1 April 2020 and will provide for a 0 tax rate for qualifying carried interest. For those in the top income brackets carried interest is typically subject to the 20 capital gains tax rate plus the 38 net investment income tax for a total tax burden of 238. In general equity issued in exchange for services is taxable at ordinary income rates unless that equity is a profits interest.

The IRS released final regulations TD. Contrast this with the highest tax bracket for ordinary income in any given year and thats a. Tax incentives include 0 tax rate for carried interest.

The carried interest loophole allows investment managers to pay the currently lower 20 percent long-term capital gains tax rate on income received as compensation rather than the ordinary income tax rates of up to 37 percent that they would pay for the same amount of wage income. And eliminating the preferential tax treatment of carried interest. Carried interest on investments held longer than three years is subject to a long-term capital gains tax with a top rate of 20 compared with the 37 top rate on ordinary income.

However income earned from managing a firms assets would be treated as regular income and taxed at the higher rate. A discussion paper on a proposed concessional tax treatment of carried interest for funds includes a 0 tax rate for. On January 7 2021 the Department of the Treasury and the IRS issued final regulations under Section 1061 of the Internal Revenue Code regarding the taxation of carried interests.

A nyone remember the carried interest loophole that lets hedge fund executives and private equity managers among the. Listen to this article. Carried Interest Fairness Act of 2021.

Tue 14 Dec 2021 0610 EST Last modified on Tue 14 Dec 2021 0904 EST.

Banking Financial Awareness 20th December 2019 Awareness Financial Banking

Bank Holidays June 2021 Check If There Is Bank Holiday In June In Your City Holiday Read Holidays In June Tech Job

Subordinated Debt Meaning Example Risk And More In 2021 Economics Lessons Accounting And Finance Financial Management

How To Avail Income Tax Benefits And Avoid Tds On Fixed Deposits Income Tax Personal Loans Income Tax Return

Latest Income Tax Slab Rates For Fy 2021 22 Ay 2022 23 Budget 2021 Key Highlights Basunivesh

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Banking Financial Awareness 20th December 2019 Awareness Financial Banking

Nbfc Incorporation Checklist In 2021 Investment Companies Business Loans Financial Institutions

What Is Carried Interest In 2021 Personal Finance Budgeting Money Personal Financial Advisor

The Margin Loan How To Make A 400 000 Impulse Purchase In 2021 Home Buying Loan House Prices

Proforma Invoice Template Download For Export Invoice Template Invoicing Invoice Design

Gstr Due Dates List March 2019 Important Dates Due Date Date List

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2022 Q1 Marketing Checklist Marketing Checklist Marketing Plan How To Plan

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe